Ten mistakes not to do when in debt

No one likes to be in debt. It is stressful and overwhelming, especially when your bills pile up and you’re unsure of what to do. In the heat of the moment, people unknowingly make poor financial decisions when trying to cope with the situation.

In this guide, my aim is to outline ten of the most common mistakes people make when in debt. Without further ado, let's begin.

-

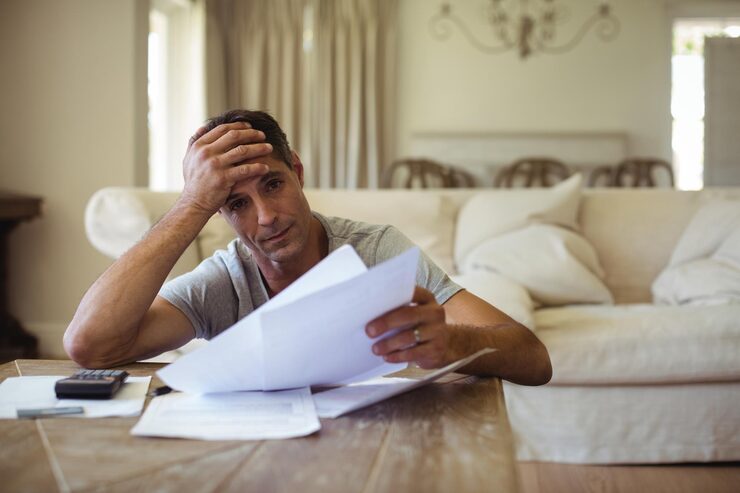

1. Ignoring Debt

One of the worst things you can do is pretend that your debts don’t exist. It may feel easier in the moment to avoid opening bills or answering calls from creditors, but this only makes your financial problems worse. Ignoring debt leads to growing balances due to late fees and interest charges. Worse, creditors may sue you, repossess your car, evict you, or cut off your utilities. No matter how stressful the situation is, face the challenge directly. Read every bill, return creditor calls, and start forming a realistic plan to pay down what you owe.

-

2. Falling Behind on Car Payments

If you miss even one car payment, your lender can repossess the vehicle, often without any warning. If you are one of the many that rely on their car for work, losing it can be devastating because without transportation, your job and daily life will be significantly harder. Your car helps you make money, so it is a must that you prioritize it.

-

3. Managing Money Without a Budget

Trying to reduce debt without a written budget is like driving blindfolded. A budget is the most important tool for managing your income and tracking your spending. Without it, it’s easy to overspend or overlook crucial payments. Review your budget regularly, ideally with every paycheck, and adjust it as your situation changes.

-

4. Paying Creditors Just Because They’re Aggressive

When you can’t afford to pay all your debts, don’t let the loudest creditor decide who gets paid first. Aggressive collectors can be intimidating, but that doesn’t mean that they can decide what is the most important to you. Prioritize based on the consequences of nonpayment.

For example, failing to pay your mortgage could lead to foreclosure. Not paying child support or taxes could result in serious legal issues. On the other hand, missing a credit card payment may take longer to escalate and can be resolved through settlement or bankruptcy. Make strategic decisions, not emotional ones.

-

5. Making Promises You Can’t Keep

When talking to creditors, never agree to pay more than you can afford. Overpromising might make them happy temporarily, but if you can't follow through, you'll lose credibility.

Don’t issue post-dated checks based on hoped-for money. Creditors can cash them early, which can cause the check to bounce and trigger overdraft fees. It’s better to be honest upfront than to break a promise and face the consequences later.

-

6. Continuing to Use Credit Cards

If you’re already struggling with credit card debt, stop using your cards. Easier said than done, but the truth is harsh. Using them while trying to pay them off is like digging a deeper hole. If you can’t pay cash, don’t buy it.

One tip: leave your cards at home or freeze them. Reducing temptation is key. Focus on paying down your existing balances before adding to them. These are difficult times. You and your family have to face the situation and admit that huge sacrifices have to be made.

-

7. Borrowing Against Your Home

Using your home’s equity to pay off debt might seem like a good solution, but it’s extremely risky. Your home is often your most valuable asset. If you can’t keep up with new loan payments, you could end up losing it.

Tapping into your home’s value should be a last resort and only when you're absolutely sure you can manage the payments.

-

8. Working with a For-Profit Credit Counseling Agency

When seeking help managing your debt, always choose a nonprofit credit counseling agency. For-profit agencies exist to make money and may not act in your best interest. They might suggest services or loans that benefit them more than you, even if it puts you at risk legally or financially. Nonprofit agencies typically offer more trustworthy advice and are more likely to focus on helping you regain financial stability.

-

9. Getting a High-Risk Loan

Desperate times can lead to desperate decisions. Accepting high-risk loans from nontraditional lenders is one of those decisions. These loans are often marketed as quick fixes but come with high fees and outrageous interest rates.

Worse, they usually require valuable assets as collateral, like your car or home, which you risk losing if you can’t repay. Always read the fine print. If something seems too good to be true, it probably is.

-

10. Asking a Friend or Relative to Cosign a Loan

When you can't qualify for a loan on your own, it might seem like a good idea to ask someone you trust to cosign. This move can possibly ruin both of your finances and relationship. If you fall behind on payments, the lender will come after your cosigner, possibly ruining their credit and putting them in financial trouble.

If you must fall, don't drag others with you. Only ask someone to cosign if you’re absolutely certain you can repay the loan and always be honest about the risks.